Arlington's Last Frontier Sells

GlobeSt.com, April 2, 2004

ARLINGTON, TX-Sam Ware of Lazarus Property Co. closes the 1,950-acre acquisition from CSFB after 550 days of honing a deal for the city's last large tract of undeveloped land. At build-out, the Lakes of Bird's Fort will represent a $761-million investment.

By Connie Gore

Star-Telegram Staff Writer

ARLINGTON, TX-A Dallas developer, staking a 75-25% partnership play, has acquired 1,950 acres in North Arlington for a mixed-use development with a projected $761-million capital investment at build-out. Rumor has it that seller Credit Suisse First Boston lost $80 million on the sale of land taken back about four years ago from an owner who went belly-up.

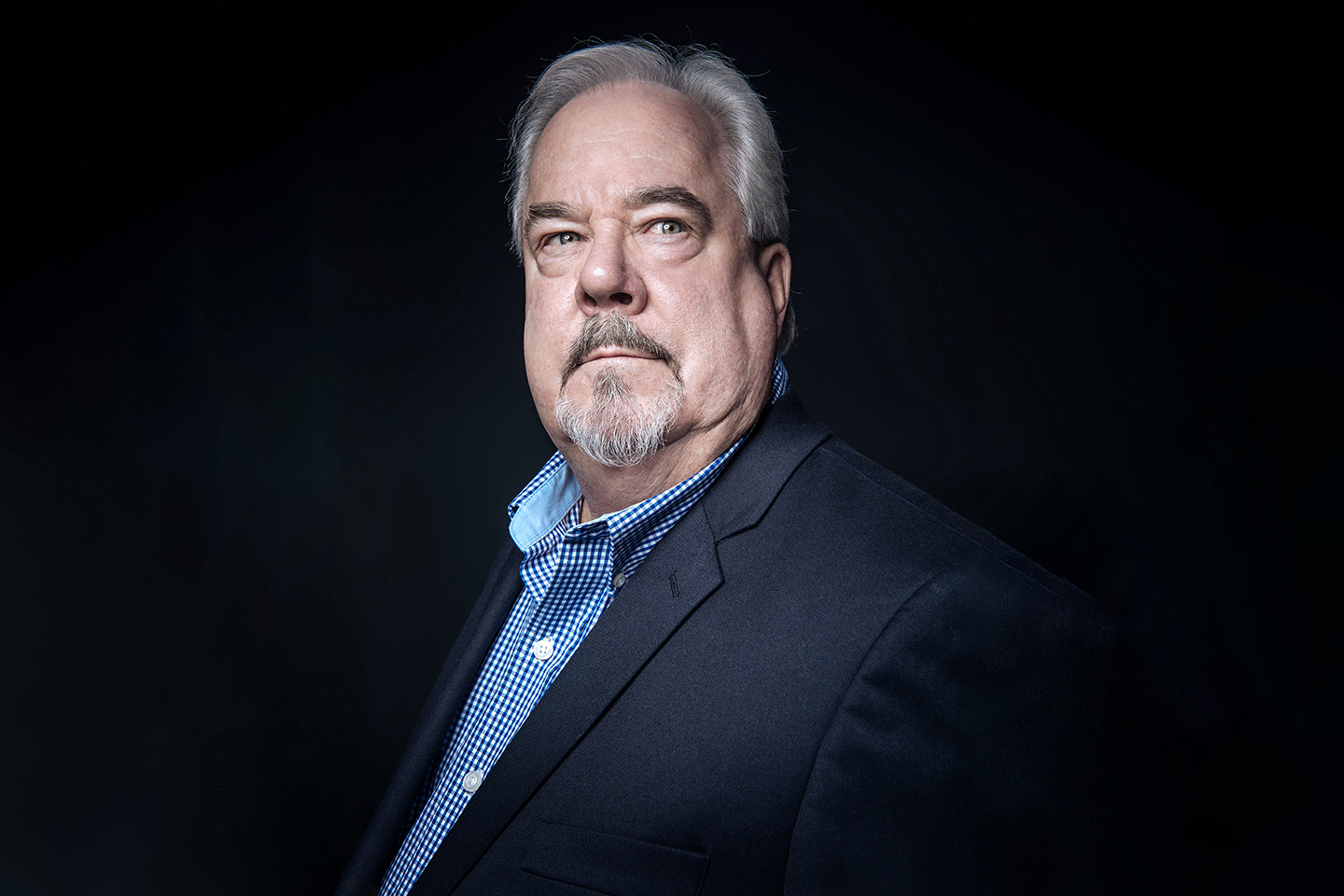

“If deals didn’t go south, I wouldn’t be in business,” Sam Ware of Lazarus Property Co. tells GlobeSt.com about his newest challenge, the Lakes of Bird’s Fort. “I buy stuff that typically needs to be redefined.” While he’s not saying what he paid, knowledgeable sources ballpark the sale at 50 cents per sf to $1 per sf for a former gravel pit that had at least $100 million pumped into it from the scuttled dreams of six owners before him.

“If anybody can get this property developed, it’s Sam,” Craig Richard, senior vice president of the Arlington Chamber of Commerce, says of the land’s seventh owner since 1980. According to the land-use plan, the build-out will result in $281 million of commercial projects and $480 million of residential development.

Ware says he had $4.5 million of forfeitable earnest money resting on the deal at Wednesday’s closing, a signing that came 550 days after the opportunity was first laid on his desk. “The city could not have been a better partner,” he says of the invested time and more to come as talks proceed for a $100-million tax increment financing district and a municipal bond sale to help with infrastructure and development costs. “I’ve had lots of challenging deals,” Ware says, “but nothing has been more complicated, more challenging at all levels…It’s been a huge team effort to get to this point. I am deeply reliant on lots of smart people around me.”

Ware, with a reputation for value-add successes, has gotten the largest tract of undeveloped land left in a town with 352,000 residents and acreage steeped in history as the region’s first settlement. Its bounds are freeways and the Trinity River while inside the perimeter are finger lakes, a flood plain that slashes the developable area to 750 acres and about 100 acres owned by a Dallas family with a decades-long claim for a part of the 1840′s Bird’s Fort settlement.

By his team’s calculation, it will take four million cubic yards of dirt to ready the land for development. Ware pegs infrastructure and site preparation costs at $35 million to $50 million. The build-out will deliver 2,000 single-family homes, averaging $250,000, on 400 acres, up to four million sf of light industrial projects on 150 acres and another 150 acres or more of commercial and retail development, which “is the great unknown,” he says of a plan that also earmarks some land for hospitality projects.

Ware estimates 90% of the work is done. Needed zoning changes are in hand, including a city first to allow natural gas wells on acreage underlain by the Barnett Shale, reputed to be the most productive in the US.

“I envision it will be another six months before you physically see dirt moving around,” Ware says. In 60 days, though, part of the team will hit the retail circuit for tenants or developers. He’s gamed out a 12- to 15-year build-out plan for solo projects, joint ventures and outright sales to developers. “It’s an opportunity that I’m very grateful came in my door early on,” he says.