TIF Incentive on Agenda

Fort Worth Star-Telegram, June 16, 2003

Council support for a tax increment finance district is mixed, with one member saying taxpayers should only help fund arterial streets feeding traffic onto major municipal roads.

By SALLY CLAUNCH JONES

Star-Telegram Staff Writer

ARLINGTON - A sprawling neighborhood with $250,000 homes, shopping centers, natural gas wells and warehouses stirs the heart of Mayor Robert Cluck.

The Lakes of Arlington, a residential and commercial development that would span about 1,400 acres of undeveloped land north of the Trinity River and west of Farm Road 157, could add about $800 million to the city's property tax base, supporters say.

But developer Sam Ware says that the project will not materialize unless the city draws a tax increment financing district, or TIE, around the tract to help fund some of the costs.

"You could give that land to me, but I wouldn't do anything with it without a TIE" Ware said. "This will not happen without it."

The City Council is scheduled to meet in closed session at 2:30 p.m. Tuesday with attorneys, the Arlington Chamber of Commerce and consultants to discuss incentives for Ware, particularly whether a TIF is feasible for the project.

Council support for the concept is mixed; several members have expressed enthusiasm for a TIF, while Councilman Steve McCollum said the city's financial support should be limited to arterial streets that would feed traffic onto major municipal roads.

Discussion of the TIF is separate from Ware's zoning request, which is scheduled for a June 24 public hearing and a possible council vote.

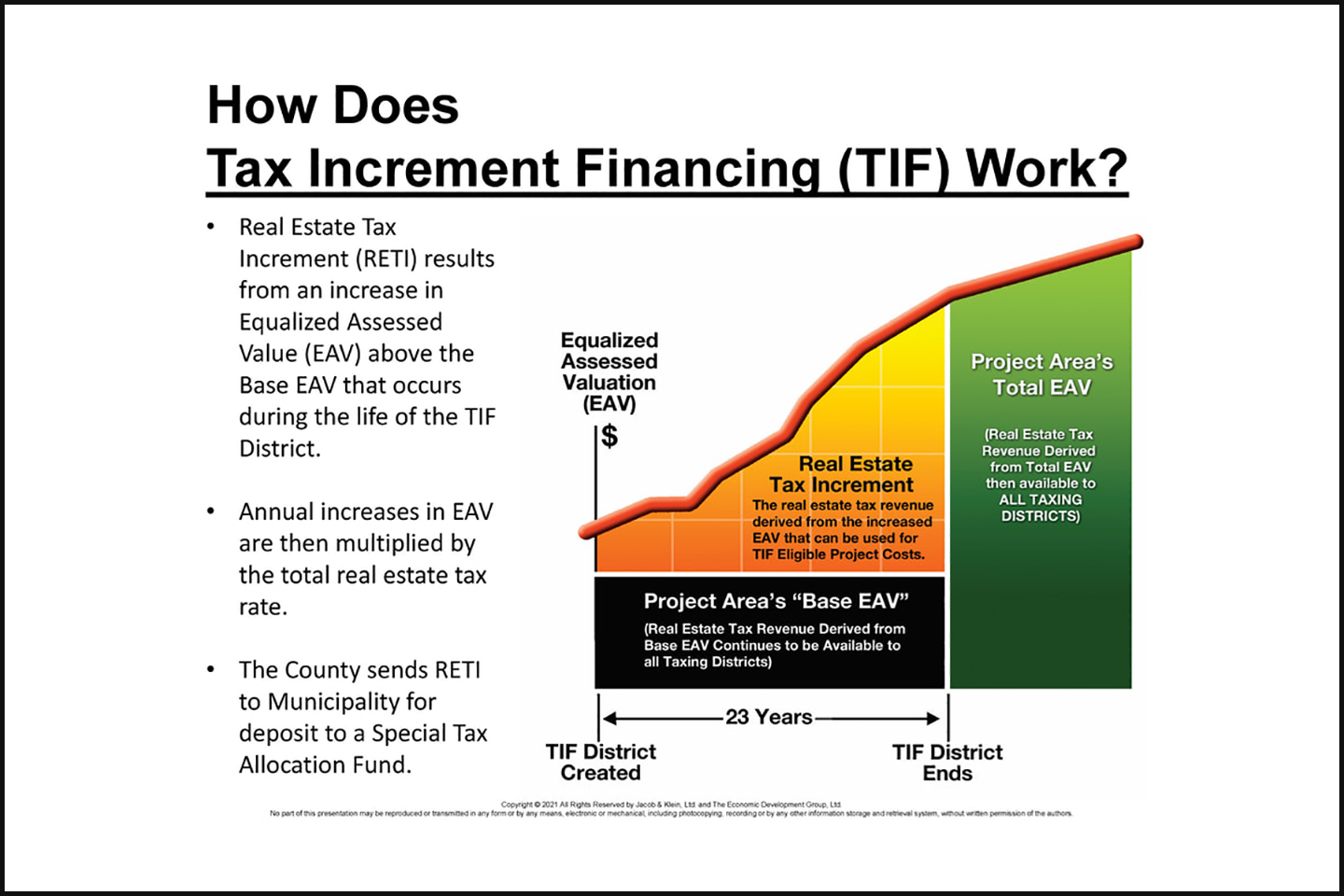

With TIFs, a local government panel, such as a city council, targets an area for development. Tax revenue generated by new construction or property value increases in the district is diverted to a fund that pays for public improvements, such as streets, utilities or lighting.

Most TIFs expire after collecting a specified amount of money or after a specified period of time, typically 20 or 30 years. Afterward, taxing entities such as school districts and cities may use the property tax dollars generated by district improvements as they choose.

"The purpose of a TIF is to enable public development that would not otherwise happen," said Mark Stein, of Mark Stein and Associates, a consultant firm that has worked on a TIF plan in Fort Worth. "It can be a good deal for Arlington because all they will be giving up is the increment. It's better than nothing."

Some TIFs work better than others.

Fort Worth city leaders created a TIF around the downtown business district in 1996 to help revitalize the area. At the time, the property within the district was valued at $297 milion.

Since then, the downtown district has increased in value by $117 million, said David Pettit, the TIF's director who works for the economic deveopment organization Downtown Fort Worth Inc. Some of the resulting tax revenue has been used to rent parking garages and provide free parking for visitors. Funds also have been used to reimburse developers for landscaping and sidewalks in the public rights of way.

"It's one of the most successful TIFs there are," Pettit said. If you invest, you want to be sure there will be other investors so you won't be abandoned downtown."

From 1986 to 1995, downtown Fort Worth attracted only two developments, both of which were apartment buildings, Pettit said. But since 1996, TIF funding has helped to attract 15 projects, he said.

Fort Worth's downtown TIF expires when $72 million in property tax revenue has been generated or in 2025, whichever comes first.

Another Fort Worth TIF aimed to revitalize the aging medical district south of downtown. The city created the TIF in 1998, when area property values had reached a low point. In doing so, officials hoped to capture potential gains in appraised value and to tunnel resulting property tax revenue into district projects.

The south side TIF, however, lost 2.16 percent in value in 1998 and lost 1.46 percent its second year.

But by 2000, the district's value was bouncing back with an increase of almost 6 percent. It was up another 7 percent in 200l and 4 percent in 2002.

"We thought it had hit bottom when we created it," said Don Scott, the TIF director and president of Fort Worth South Inc., the nonprofit agency that administers the TIF. "We're doing OK now."

Over its history, the TIF tund has collected about $1 million. Scott is working with some developers who want to use TIF money to recover costs for landscaping, trees and sidewalks around a loft apartment complex planned in the district, among other projects.

"We'll use the TIF dollars to stimulate the first developers, and then you don't have to reimburse others because it will be a place everyone wants to be," he said. "Then you can use the TIF for things like art."

The south side TIF will expire when $60 million has been collected.

In Southlake, the TIF experience has been difficult. The city created a TIF to help fund its Town Square development in the late 1990s, and the TIF issued bonds against the revenue the TIF was projected to generate.

When development stalled after the Sept. 11, 2001, terrorist attacks, the city was in a severe financial bind. This year, the city will cover an $880,000 payment on TIF bonds. The payment is expected to rise to $1.2 million next fiscal year, Southlake City Councilman Tom Stephen said.

More development is coming, Stephen said, but it may not be there in time to generate enough revenue to cover the next round of bond payments.

"It's a horse race between the tax revenue coming online before the debt service increases," he said.

Stephen said if bonds had not been issued, some infrastructure costs would have to be paid by developers up front.