Bank Files Foreclosure on Rights to Minerals

Fort Worth Star-Telegram, October 20, 2010

A developer used the rights under 1,900 acres in north Arlington as loan collateral, records show.

By SANDRA BAKER

A Dallas-based real estate developer who thought he had the makings of a lucrative natural gas holding under 1,900 acres of undeveloped land in north Arlington may soon lose the mineral rights to the Texas bank that loaned him money for the deal.

PlainsCapital Bank filed foreclosure proceedings against Sam Ware, who bought the land, north of Green Oaks Boulevard and east of Collins Street, in 2004 and named it Lakes at Bird's Fort. Ware used the mineral rights as collateral on several millions of dollars in loans, according to deed records.

But Ware said this week that his exploration efforts, which included plans for 30 or more wells, were disappointing.

"I hate that this is happening," Ware said. "It didn't end up as I hoped. I had high hopes for the minerals."

The mineral rights are scheduled to be auctioned Nov. 2 on the Tarrant County Courthouse steps.

Kerri Fulks, a Dallas-based spokeswoman for PlainsCapital, declined to comment on the pending foreclosure, saying the bank "can't talk about our clients."

In addition to facing foreclosure, Ware is being sued by investors who allege they were promised a 25 percent stake in the mineral rights.

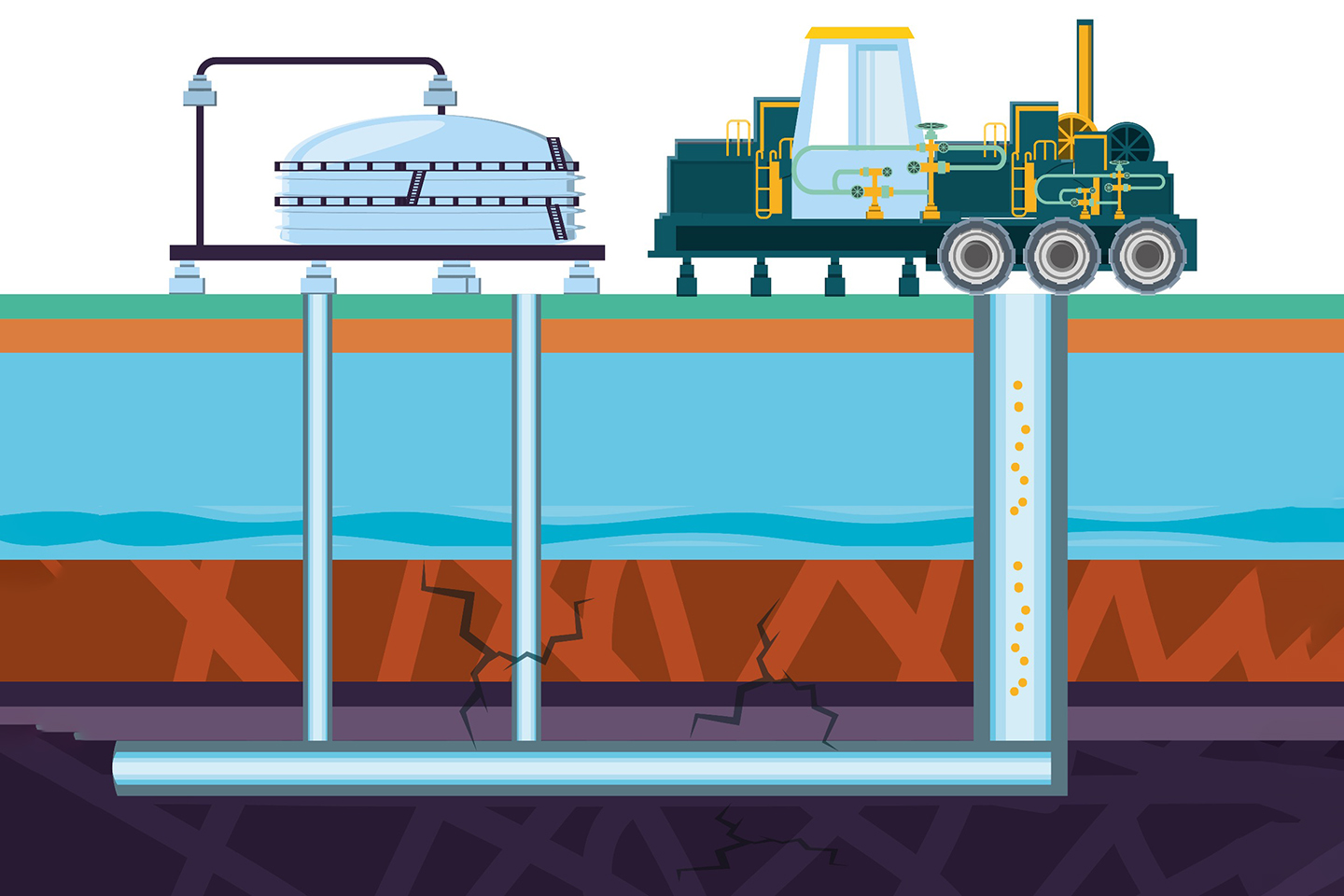

The land is in the heart of the Barnett Shale, a huge natural gas field under more than 20 North Texas counties that is particularly rich in Tarrant and Johnson counties. The shale has been lucrative to many gas operators in the past decade, but with natural gas prices sharply lower and operators no longer paying big lease-signing bonuses, Ware said he's abandoned drilling.

In 2007, Ware sold the surface land to Dallas-based Huffines Communities but retained the mineral rights.

Ware entered into an operating agreement with Star of Texas Energy Services, an Austin-area firm that has drilled in the Barnett Shale, to develop his property. After that deal ended in 2007, Ware said, he turned to Range Resources, one of the larger producers in the Barnett Shale, in March 2008 to help develop the property. By late 2008 however, natural gas prices had plunged, and by June 2009 Range ended the deal.

Rodney Waller, a senior vice president at Range Resources, said the company completed one well and drilled but did not complete a second well before pulling out. As a result of "complex geology" at the site, he said, Range Resources "opted not to do other drilling."

The completed well has been a marginal producer. According to Texas Railroad Commission records, between August 2008 and July, the well produced slightly more than 163.1 million cubic feet of gas. At an average of $6 per 1,000 cubic feet, that would amount to less than $1 million, less than half the cost of drilling and completing a typical Barnett Shale well.

Ware said he's had a few other Barnett Shale operators look at the site in the past year, but none have pursued a lease. "I couldn't get anyone back in to drill," Ware said. "It didn't make sense to keep it going."

Ware declined to comment on the lawsuit, filed by the investors in November in state District Court in Tarrant County.

According to an Oct. 12 filing in the case, Ware has reached a settlement agreement with Travis Ranch Development, 2428 Management Llc. and IHP Investment Fund III, longtime investors in Ware's real estate projects. Those parties say they were given 25 percent of the minerals at Lakes at Bird's Fort to settle a previous business dispute.

An undisclosed settlement payment is due by Dec. 20, the filing said.

Huffines Communities renamed the development Viridian. Its plans include a town center, loft apartments above offices and shops, and villagelike neighborhoods with homes costing $300,000 to $1 million.